We’re in This Together: Family Financial Literacy & Stewardship

When looking at the church bulletin, I read through the list of people who pledged at Calvary this season and felt grateful to see names of long-time and new members. As I scrolled through familiar adult names I was surprised and delighted to come across children’s names. A publicly recognized child’s or youth’s pledge is faith-formation and inclusion in action! When I see children’s names, I see the partnership of parent and child at work, as well as the growth of a child’s understanding of their agency to be financially generous. Because children do not generate income other than what they might receive from parents or family members, a church does not expect them to be financial contributors.

In years past, children collected coins in the paper fish banks for One Great Hour of Sharing. Even when facilitated, that practice has fallen by the wayside, especially because most families don’t handle coins or cash anymore. One time a child attending Sunday Studio handed me their $45 Calvary donation which they had diligently collected throughout the year. Children and youth have long been successful in holding bake sales, raffles, parent night out fundraisers in order to pay for a youth trip, children’s enrichment program, or donate to an organization such as Raphael House. There are many ways to bring about this intersectionality of faith, financial literacy, and global generosity, but parents and adult guides need to initiate and consistently facilitate the process. Pledging or providing an offering are additional ways for confirmands to participate in the adult world of worship and meetings.

In a 2018 Presbyterians Today article, author Pam Greer-Ulrich relayed ways parents and congregations can support children, youth, and families in nurturing financial stewardship. “Gina Struensee, director of Christian education at First Presbyterian Church in Neenah, Wisconsin, has this advice: Start young. It doesn’t take long for children to recognize the value of money. In a 2018 study, psychologists at Purdue University found that by age 3, children can grasp basic money concepts. By age 7, money habits that will follow children into adulthood have been formed. “The younger the parents start, the better,” she said, adding that the church can be integral in nurturing generous givers. “Stewardship can be woven into the fabric of our Christian education programs and throughout all of church life,” Struensee said. “It would be amazing if the culture of every church involved the whole congregation in discussion, classes and opportunities for stewardship activities throughout the year — not just during the annual ‘campaign.’”

If children and youth imitate a healthy model of their parents’ financial literacy, they are understanding where their money goes, what experiences funds create, and what resources pledges sustain. They see that collecting financial resources builds power to support people in need. Children can begin to save when they are 5 years old, can work with parents to deposit money into a savings account, and eventually manage their own checking or savings accounts. As teens, they can decide how their money is spent or saved thereby accepting personal responsibility and understanding the scope of money’s purchasing power.

A 2020 Pew Research article by Jeff Diamant and Elizabeth Podrebarac Sciupac shows the effects of parent modeling on the long-term outcome of youth religious activities, which in turn could inherently reflect a young adult’s fluency of financial stewardship and regular giving practices.

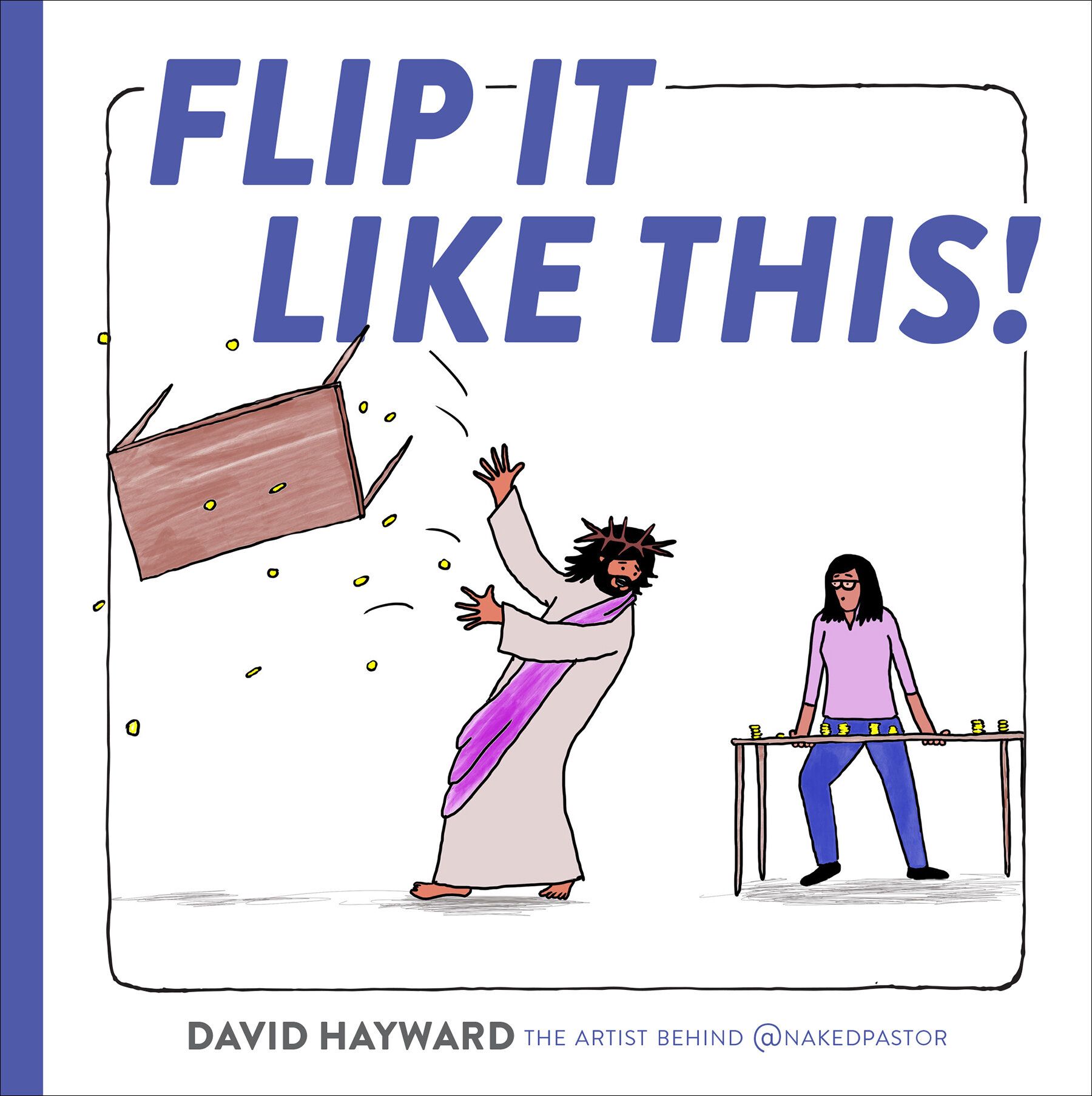

Diamant writes, “When it comes to religious activities in general, about two-thirds of teens who do religious things with their family say they do so partly or mostly because their parents want them to. But even if teens are participating to please their parents, they seem to be getting something out of it: Around three-quarters of teens who engage in religious activities with their family say these pursuits bring them “a lot” of enjoyment (27%) or “some” enjoyment (51%). And many teens express both sentiments: Among teens who say they participate because their parents want them to, 79% also say they get at least some enjoyment from it.” Could we say that young people could normalize giving on a regular basis? A few months ago, Rev. Marci Glass handed me the book This Could Be Our Future: A Manifesto for a More Generous World by Yancey Strickler, cofounder of KICKSTARTER.

Marci encouraged many Calvary officers to read the book so we can eventually have dialogue about it. Strickler highlights our national obsession with financial maximization which traps us by a limited perspective. Stickler comments, “How do we become free of these limitations? By acknowledging how big the universe actually is… Many of us can’t say what our values are. We’re too busy trying to achieve financial security to search for a meaningful philosophy of life…Whether we get there [to a more generous world] will largely decided by how Generations X, Y, and Z manage the many crises that have piled up over the past several decades.”

This overall culture consciously and subconsciously clashes with values of delayed gratification, humane treatment of workers, reusing of materials, and equity. We need to be financially healthy and believe in the power of using money for good. When financial maximization prioritizes over our sleep cycles, time with family, or mental health, we know that this is not God’s path for us. Many people are working more than one job, so the family directly experiences a loss of time together, which could mean that they forego attending church on Sundays altogether.

Considering The Great Resignation, many people are waking up to what we have been and are looking for a new path to economize their outgoing energy and maximize time to find a sense of meaning and wonder. Returning to the Pew Research article, the 10th key point about children and youth today is that they are still finding a sense of wonder and gratitude. “Half [of teens] feel a deep sense of spiritual peace and well-being at least monthly, while 46% say they think about the meaning and purpose of life and 40% report feeling a deep sense of wonder about the universe. The most common experience is a strong feeling of gratitude or thankfulness, reported by 77% of teens in the survey.”

If we go by this data, I would say that the next generation has a good chance of translating wonder and gratitude into financial stewardship locally at church and globally through social media giving opportunities. Remember the memes that said that the new generations don’t want a parent’s furniture, dishes or keepsakes? I think that new generations want experiences, meaning, and deep interaction with others. We can learn how to foster this alongside of them and shed some inherited Scotch Presbyterian tendencies to hold on to objects and money too tightly for fear that we will not have enough. We want our children to understand that much of the world experiences scarcity on a daily basis, but also recognize the abundance that exists.

Photo: Children “sow seeds of love” by putting kale seeds into soil. Money can be like seeds and grow into potential to create healthier and more equitable communities.